Facilitate Payment Processing

GST Regulations

Ensure GST compliance by calculating, reporting, and filing taxes without errors.

TDS Deductions

Deduct and deposit TDS properly to meet taxation laws and avoid penalties.

Merchant Obligations

Maintain accurate tax records, file returns timely, and ensure legal compliance.

Financial Reporting

Keep structured financial reports ready for audits, tax filings, and assessments.

Regulatory Filings

Submit required tax documents on time to prevent compliance-related legal issues.

Penalty Avoidance

Follow taxation laws carefully to avoid fines, disputes, and business disruptions.

Forecast Revenue Trends Accurately

Smarter Decisions Faster

Transaction Analysis

Examine payment data and trends to improve accuracy and business growth.

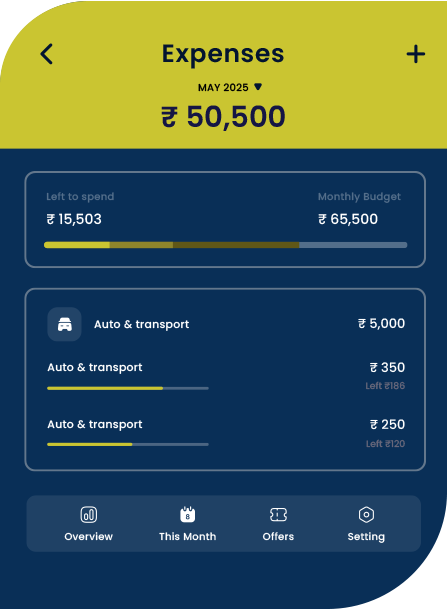

Revenue Insights

Analyze earnings flow and patterns to enhance profitability and financial stability.

Expense Trends

Evaluate processing costs and spending to optimize budgeting and resource allocation.