Protect Every Payment Securely

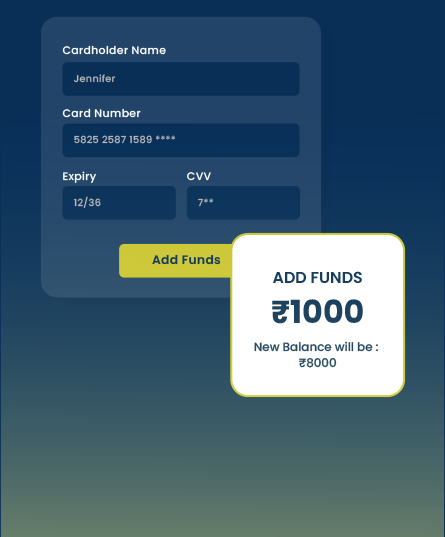

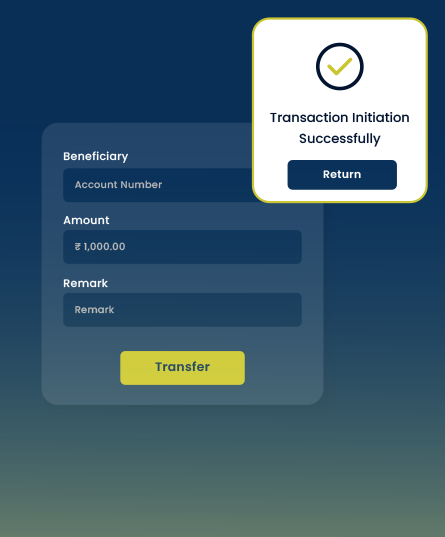

Transaction Initiation

Cybersleekindus starts escrow when both parties agree on transaction terms securely.

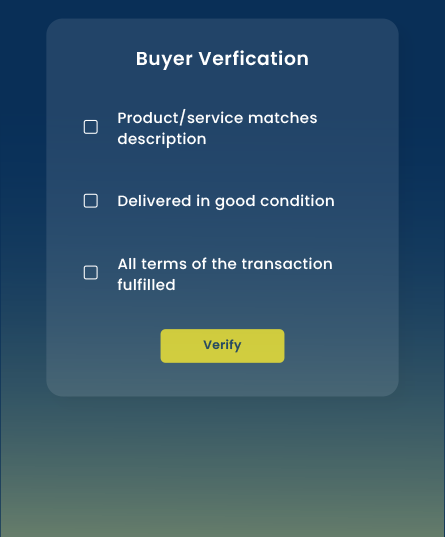

Buyer Verification

Buyer inspects received goods or services and confirms order satisfaction securely.

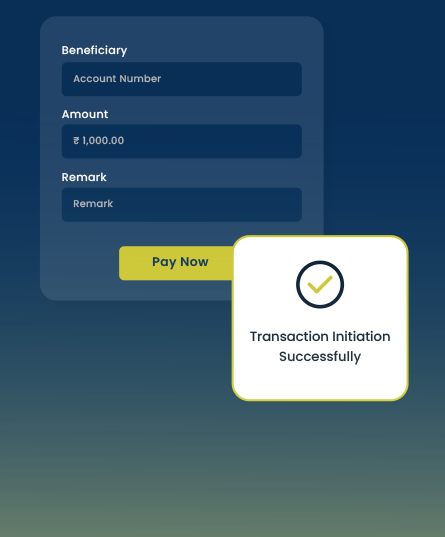

Funds Release

Cybersleekindus transfers funds to the seller after meeting escrow conditions successfully.

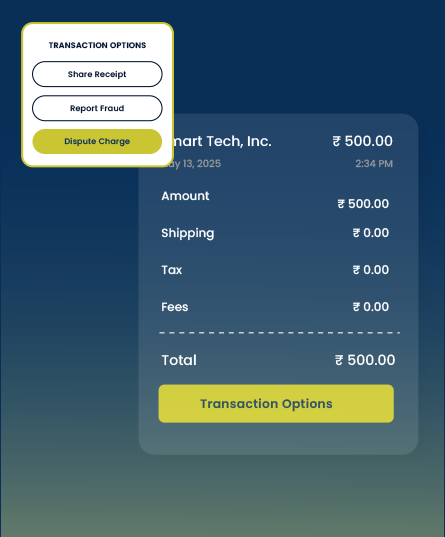

Dispute Resolution

Conflicts are handled fairly with structured solutions ensuring secure transactions always.

Keep Payments Securely Managed

Fraud Prevention

Protects digital transactions by holding funds until both parties fulfill agreements.

Secure Transfers

Ensures payment release only when all contractual obligations are successfully met.

Risk Elimination

Minimizes financial losses by verifying every transaction before final processing.

Clear Agreements

Defines payment terms in advance to prevent disputes between involved parties.

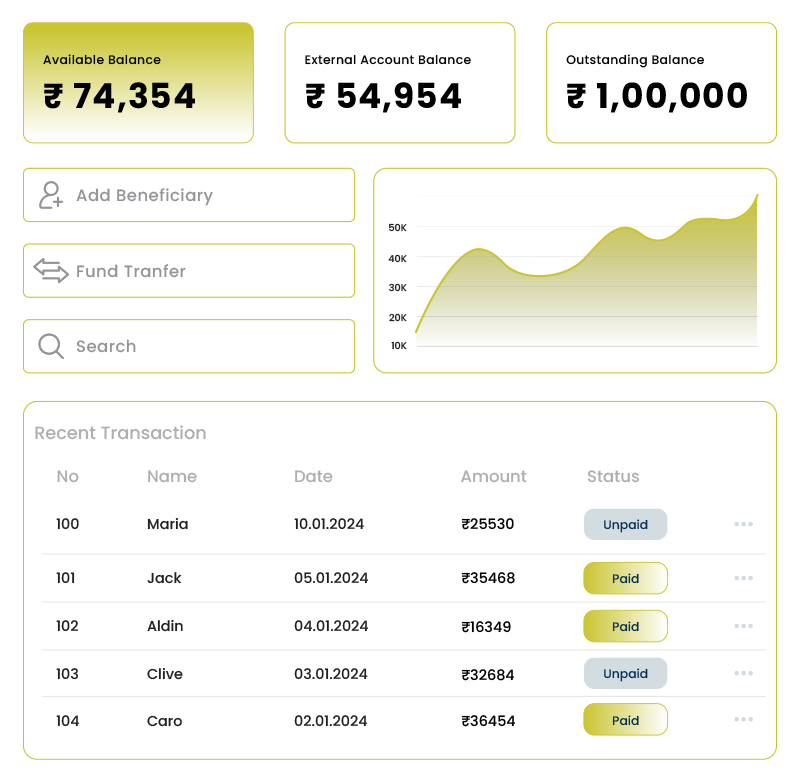

Fund Visibility

Allows easy tracking of escrowed money throughout every stage of the transaction.

Verified Processing

Validates and authenticates payments before transferring funds to recipients securely.

Dispute Resolution

Resolves conflicts fairly by ensuring both parties comply with transaction terms.

Legal Compliance

Adheres to financial regulations to provide a compliant and secure payment process.

Contract Assurance

Guarantees agreement enforcement by ensuring fund release after term fulfillment.

Smarter Money Movement Anytime

Cybersleekindus simplifies transaction handling with secure, automated financial management tools. Monitor payment statuses, approvals, and settlements with flawless integration into business systems. Enhance operational efficiency by reducing errors and ensuring accurate financial reconciliation. Gain complete transparency with structured reports, helping businesses make data-driven decisions.

- Payment Monitoring

- Fund Reconciliation

- Status Updates

- Settlement Insights

Ensuring Secure Escrow Transactions

Risk Mitigation

Cybersleekindus minimizes payment risks by safeguarding funds until conditions are met.

Identity Verification

Multi-layer authentication ensures only verified parties engage in escrow transactions.

Legal Assurance

All escrow agreements follow strict compliance with financial and legal regulations.